Introduction

Pakistan offers diverse opportunities for investors in 2025, ranging from real estate in major cities to stocks, ports, and export hubs. While challenges exist, sectors like commercial property, capital markets, and industrial zones continue to show promise. In this article, we highlight the top five places to invest in Pakistan, explain their potential, and share tips for getting started.

1. Karachi — The Commercial & Capital Markets Hub

As Pakistan’s largest city and financial capital, Karachi remains a prime choice for investors. It hosts the Pakistan Stock Exchange (PSX) and is home to key industries, ports, and commercial real estate.

Why invest:

- Strong demand for commercial and residential property in areas like Clifton and PECHS.

- Access to diversified PSX equity funds and stocks.

- Continuous business activity makes it the country’s economic heartbeat.

Tip: Beginners can start by exploring REITs (Real Estate Investment Trusts) or low-entry PSX mutual funds.

2. Lahore — Residential Growth & Industrial Development

Lahore’s population growth and expanding infrastructure make it a hotspot for residential and industrial investment.

Why invest:

- High demand for housing in gated communities and developed neighborhoods.

- Rising interest in manufacturing and IT sectors.

- Strong rental yields in popular family areas.

Tip: Focus on ready-possession properties in safe, developed zones to minimize risk.

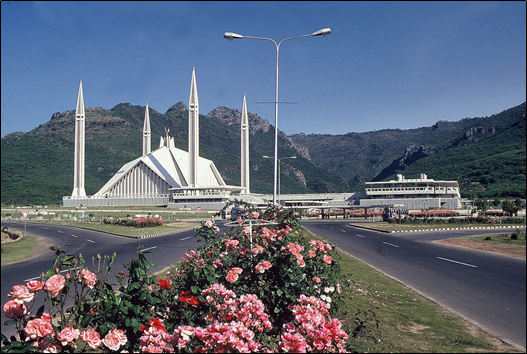

3. Islamabad — Premium Stability & Government Backing

Pakistan’s capital offers a mix of modern living and stability. With embassies, government offices, and a growing tech workforce, demand for premium rentals is strong.

Why invest:

- Consistent demand for apartments and townhouses.

- Safe environment compared to other urban centers.

- Attracts both expats and professionals.

Tip: New micro-apartments and co-living spaces are gaining popularity — ideal for young professionals.

4. Gwadar — Long-Term Port & SEZ Potential

Gwadar is part of the China–Pakistan Economic Corridor (CPEC) and has been in the spotlight for its deep-sea port and Special Economic Zones (SEZs).

Why invest:

- Strategic location for trade and logistics.

- Major infrastructure projects under development.

- Potential for exponential growth in 10–15 years.

Caution: Gwadar is a high-risk, high-reward investment. Timelines, security, and infrastructure challenges may delay returns.

5. Sialkot & Faisalabad — Export & Industrial Hubs

Beyond the big cities, these industrial hubs present unique opportunities.

Why invest:

- Sialkot is globally recognized for sports goods exports.

- Faisalabad is Pakistan’s textile powerhouse.

- Export-driven industries attract foreign buyers and create SME investment opportunities.

Tip: Consider partnerships with SMEs (Small & Medium Enterprises) or supply-chain investments linked to export industries.

How to Start Investing in Pakistan

If you’re new to investing, here’s a simple roadmap:

- Research: Study local real estate trends and PSX market reports.

- Choose your sector: Real estate, stocks, export industries, or long-term port projects.

- Work with professionals: Always consult licensed brokers, lawyers, and financial advisors.

- Diversify: Don’t put all your money in one city or sector.

- Start small: Test the market with low-entry funds or smaller property deals.

Conclusion

The top 5 places to invest in Pakistan in 2025 — Karachi, Lahore, Islamabad, Gwadar, and Sialkot/Faisalabad — highlight the country’s diverse opportunities. Karachi offers unmatched commercial activity, Lahore brings residential and industrial growth, Islamabad ensures stability, Gwadar promises long-term port potential, and Sialkot/Faisalabad drive export strength.

Each carries its own risk–reward profile, so success depends on research, diversification, and professional guidance. Start small, stay informed, and align your investments with long-term goals.

Pakistan’s future is full of opportunities — the question is, which city will you choose to invest in?